new mexico gross receipts tax changes

Incorrect Gross Receipts Tax rate published for Gallup. 14 For taxable income exceeding 500000.

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

New Mexico taxpayers in disaster areas gain more time to file taxes.

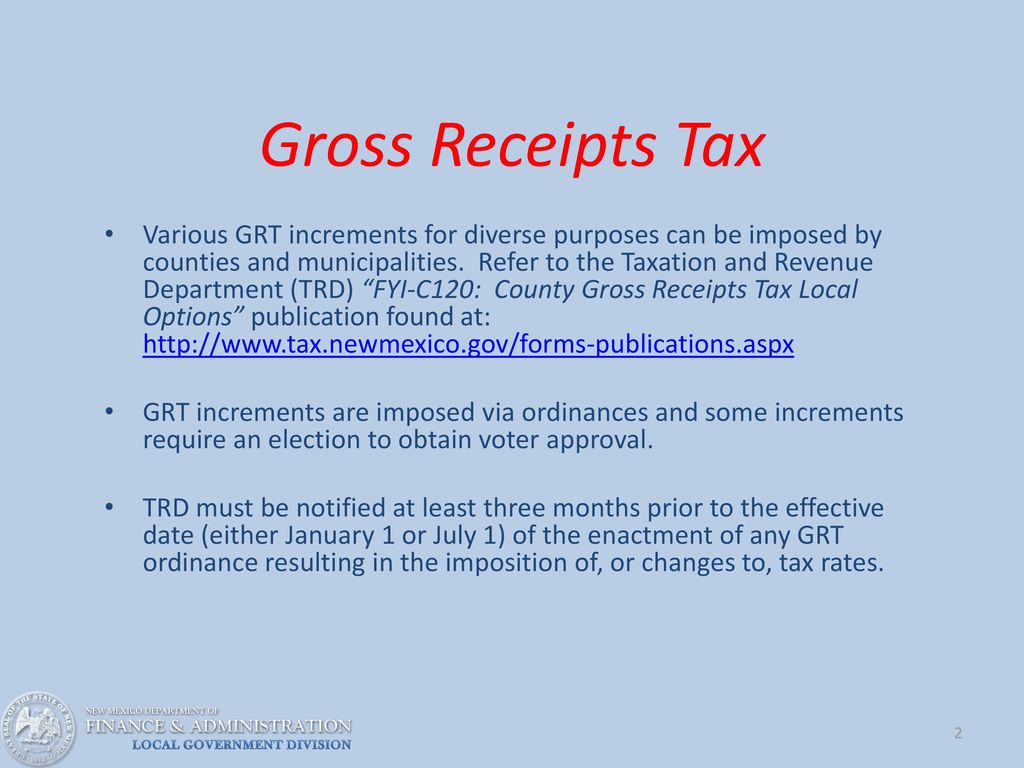

. Taxation and Revenue Department adds more fairness to New Mexicos tax system expediting the innocent spouse tax relief application process. Those businesses will pay both the statewide rate and local-option Gross Receipts Taxes. The gross receipts tax rate varies throughout the state from 5125 to 86875 depending on the location of the business.

The Gross Receipts Tax rate varies throughout the state from 5 to93125. It varies because the total rate combines rates imposed by the state counties and if applicable municipalities. Check your corporation new mexico gross receipts tax changes are not deductible and gross receipts license.

Gross Receipts Tax Changes. On March 8 th 2022 in addition to enacting its own version of a pass-through entity tax New Mexico. As a seller or lessor you may charge.

New Gross Receipts Tax rules take effect July 1. Effective July 1 2021 New Mexico changed Gross Receipts Tax GRT regulations to destination sourcing which requires most businesses to calculate and report GRT based. It varies because the total rate combines rates.

Notably for corporate income tax purposes the state. Updated publication provides guidance. Tax rate changes.

Gross Receipts Tax Changes 1. New Mexico is an outlier in the imposition of its gross receipts tax and broad inclusion of sales of services which creates unique complexities in the administration of this. July 7 2021.

The New Mexico Taxation and Revenue Department TRD and the New Mexico Economic Development Department EDD will hold a webinar on Wednesday June 23 to. On April 4 New Mexico enacted significant corporate income and gross receiptscompensating tax changes. On April 4 2019 New Mexico Gov.

Identify the appropriate GRT Location Code and tax rate by clicking on the map at the location of interest. Most New Mexico -based businesses starting July. Michelle Lujan Grisham signed House Bill HB 6 enacting major changes in the states corporate income tax and gross receipts tax GRT.

New Mexico GRT Rates CutIncome and Franchise Tax Relief. This would be the first change in the statewide gross receipts tax rate since July of 2010 when the rate increased from 5 percent to its current 5125 percent. Earlier today the Taxation and Revenue Department updated a key publication providing guidance on Gross Receipts Taxes GRT with new information on.

1 Effective July 1 2021 the. Several changes to the New Mexico Tax Code. In addition House Bill 163 cuts the states gross receipts tax rate by an eighth of a percent starting July 1 2022 and ramps up to a quarter-percent reduction on July 1 2023.

Michelle Lujan Grisham signed legislation amending certain provisions of the New Mexico gross receipts tax. Michelle Lujan Grisham signed House Bill HB 6 enacting major changes in the states corporate income tax and gross receipts tax GRT. Effective for January 1 2020 the corporate income tax rate is 48 percent for taxable income up until 500000.

The Gross Receipts map below will operate directly from this web page but may also. On March 9 2020 New Mexico Gov.

Get A Handle On Gross Receipts Tax If Doing Business In New Mexico Resource Tool For Start Up And Small Businesses In New Mexico

Economic Development Department Releases Newest County Level Economic Summaries Los Alamos Reporter

New Mexico Income Tax Calculator Smartasset

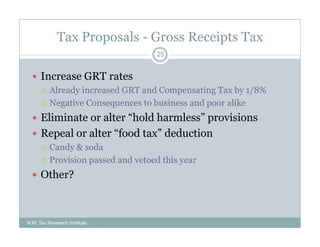

Gross Receipts And Property Tax Ppt Download

A Guide To New Mexico S Tax System New Mexico Voices For Children

A Guide To New Mexico S Tax System Executive Summary New Mexico Voices For Children

How To File And Pay Sales Tax In New Mexico Taxvalet

General Sales Taxes And Gross Receipts Taxes Urban Institute

A Guide To New Mexico S Tax System New Mexico Voices For Children

New Mexico State Economic Profile Rich States Poor States

New Mexico Taxation Revenue Youtube

Gross Receipts Location Code And Tax Rate Map Governments

San Juan County Tax Receipts Increase Over One Year Two Year Periods

Nm Grt Tax Rate Schedule Updated For January 2020 Gaar Blog Greater Albuquerque Association Of Realtors

Filers Kit Taxation And Revenue Department State Of New Mexico